- October 17, 2013

- Posted by: Trent Wagner

- Category: News

Congress finally came to an agreement late yesterday and, much to the surprise of nobody, we avoided the first US debt default in history. As always, anytime we see a big geo-political event unfold, we are focusing our efforts on finding opportunity in the markets as a result of market moves that can be attributed to such events. As of this writing, the equity markets are mixed with the S&P 500 up a little and the DJIA down a little. Not exactly surprising given that the markets moved so much higher over the course of the past week, it’s safe to say that the deal reached in Washington last night was appropriately priced into the market prior to it being official. In summary, there are no fireworks to speak of in the equity markets as a result of the deal. However, that’s not the case in call sectors – gold has our attention today.

Unlike the equity markets, we have seen a substantial move in gold today in the wake of yesterday’s debt deal. In the overnight session, gold jumped approximately $40/oz. in less than 15 minutes and has held on to the majority of those gains thus far through today’s session, with the front month contract trading near $1320/oz. The move is somewhat perplexing, given that throughout the past week as the equity markets swung between gains and losses in intraday trading based on the most current headline concerning the debt ceiling, we saw gold trading on the reciprocal side of the equity markets – seemingly returning to its “safe-haven” status at least for the time being. So, intuitively one would have thought that the actual deal coming together would have sent gold lower given the aforementioned price action earlier this week. Instead, we see the biggest rally the gold market has had since September 18. Because of this seemingly defiant price action today in gold, there are many analysts pointing to this move as a reason to re-enter the gold market on the long side, I’m not one of them. In fact, I believe the move today has effectively given those on the sidelines another opportunity to get in on the short side of the gold trade.

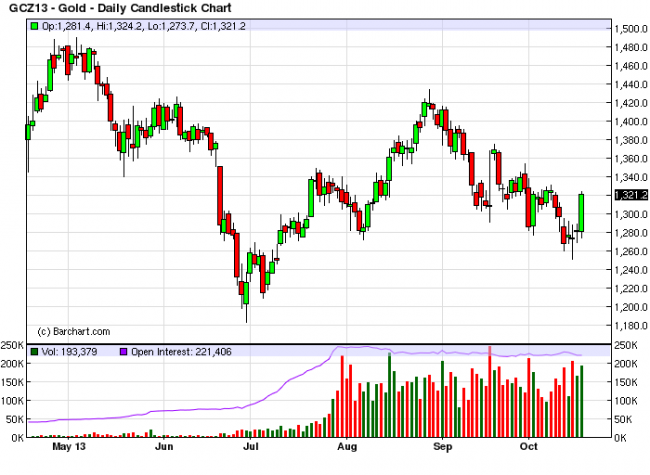

The reason I am skeptical of the long side of the gold market right now is that, effectively, nothing has changed. The headwinds that have plagued longs in the gold market throughout this year are still very much in play – inflationary pressures have yet to hit the economy and equity markets remain strong. Although today’s move to the upside is substantial, much of it can be attributed to the dollar index dropping to its lowest level in nearly 8 months. Based on the last few times we’ve seen the dollar index have a substantial drop and, more importantly for this topic, how gold has reacted to those drops – I do not believe that today’s gains will be sustained very long. Take a look at the gold chart below:

I mentioned that today’s rally in the gold market is the biggest single-day move to the upside since September 18. You may remember the significance of that date, it was the day that Bernanke surprised everyone as he announced in the wake of the Fed’s September meeting that there would be no tapering as economic conditions (in the FOMC’s opinion, of course) did not warrant for a scale back in the purchasing program. This was extremely bearish for the dollar and, as a result, we saw the dollar index fall hard and gold rise over $50/oz. in a matter of minutes. However, as you can see from the chart, the market was not able to hold these gains for long. In fact, just two days later the gold market had already given back over half of that initial move up. What is even more interesting is that as gold was giving up these big gains the dollar index during this time DID NOT retrace. Ultimately, we’ve seen the gold market react initially in an extreme way to the dollar dropping only to have the market effectively shrug this off after a few sessions. Although it may not be for a few months, the Fed will eventually pull pack on these bond purchases. If gold has managed to sell off this year with the dollar trading near its lows, imagine what happens when the dollar index actually rallies . . .

Questions or comments? Contact Trent directly at 312-756-0932 or at twagner@tradewithfox.com. For a free trial of Trent’s newsletter, The Weekly Options Trading Report, click on the link below and select “Options Newsletter” from the dropdown box on the subject line.

https://www.tradewithfox.com/contact/

*Past performance is not indicative of futureperformance. Trading futures and options involves substantial risk of loss and is not suitable for all investors.